THE CENTER OF GRAVITY FOR ENTREPRENEURS IN TEXAS

(Contributed by Gordon Daugherty, Capital Factory President)

This post isn’t intended to get into every detail of convertible note mechanics. But I get enough questions about when to use them and what the basic components are that I thought a basic primer was in order. For those interested in the seed-stage SAFE investment instrument made available by Y Combinator in December 2013, ready my review and comparison to convertible notes here.

When To Use

Convertible notes are a form of financing (fundraising) that are most commonly used in the earliest stages of company formation when the value (valuation) of the company is impossible or undesirable to establish. Setting a valuation for a company in the early stages is already part art and part science but in the earliest stages it is almost all art. Actually, it’s purely the intersection of how much equity (ownership) the founders are willing to give up and how much equity the investor demands for their investment.

Some investors refuse to invest via convertible note because of the future uncertainty of how much equity they will eventually receive (explained in next section) while other investors have no issue with this fundraising instrument. It is somewhat of a religious debate. Another example of when convertible notes are used is for a “bridge round”, which is a relatively small amount needed to bridge the gap to the next desired equity round (for example, in between a Series A and a Series B).

Comments

Categories

Tags

Questions?

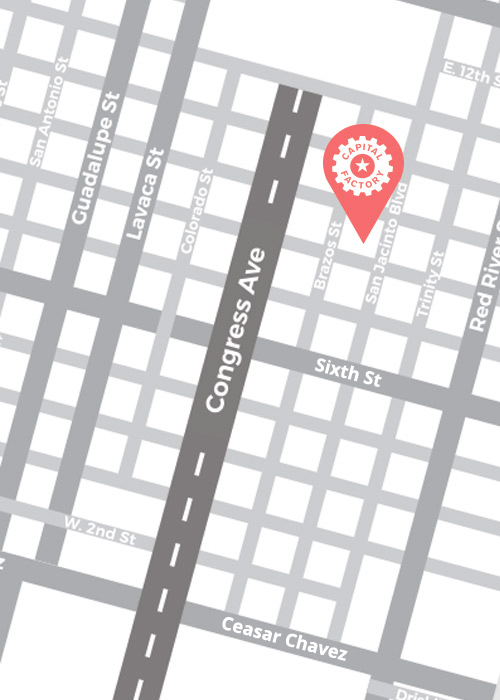

By Appointment Only

Our doors are open! Reach out to Members@CapitalFactory.com to book your private, in-person membership tour.