Capital Factory + FLOODGATE + Silverton = $150,000

Capital Factory, Silverton Partners and FLOODGATE Announce Matching Investments for All Capital Factory Incubator Companies

$150K Total Will Be Invested in Each Qualifying Venture; Program Begins Immediately

Capital Factory, Silverton Partners and FLOODGATE today announced a joint initiative to provide $150K of financing for every qualified start-up that is selected to participate in the Capital Factory program.

The program starts immediately. Finding two Capital Factory mentors who agree to invest $25K each automatically triggers a matching VC investment of $50K from Capital Factory’s in-house fund, and $25K each from Silverton and FLOODGATE.

@CapitalFactory + FLOODGATE + @SilvertonVC = $150,000 pic.twitter.com/f7S1yZ6QD8

— Capital Factory (@CapitalFactory) February 3, 2014

Announcing @silvertonvc & FLOODGATE will match investments made by CF Partners in our Incubator startups. @kipmcc @m2jr @mflager @JoshuaBaer

— Capital Factory (@CapitalFactory) February 3, 2014

This brings our 2014 Incubator companies a strong connection to a local VC and a top Silicon Valley VC with a total of $150,000 investment.

— Capital Factory (@CapitalFactory) February 3, 2014

The matching investment is usually made using a convertible note with a $3m cap and 20% discount. 2 CF Partners must invest $25k each.

— Capital Factory (@CapitalFactory) February 3, 2014

1. Join the Incubator 2. Convince two CF Partners to invest $25k each. 3. Get $50k from us and $25k each from @SilvertonVC and Floodgate

— Capital Factory (@CapitalFactory) February 3, 2014

The list of Partners eligible for matching funds are labeled Partner here (first you must join the Incubator) http://t.co/0zlEXKpRka

— Capital Factory (@CapitalFactory) February 3, 2014

In order to qualify for matching funds, startups must first be accepted to our Incubator. Apply at http://t.co/FwdijLzWoh

— Capital Factory (@CapitalFactory) February 3, 2014

been a mentor at @CapitalFactory since Day 1 & have since funded @Sparefoot @Famigo @RecycleMatch @NuveTeam from @SilvertonVC. Who's next?!

— Kip McClanahan (@kipmcc) February 3, 2014

A Thunderlizard comes out of Austin every year. I want to find it, fund it and encourage more! via @CapitalFactory http://t.co/9y07GtKUKP

— Mike Maples (@m2jr) February 3, 2014

Big milestone today for @CapitalFactory — announcing matching investments from @SilvertonVC and Floodgate, 2 of the VC’s I respect the most.

— Joshua Baer (@JoshuaBaer) February 3, 2014

Press who want to learn more about our matching investment should contact @joshuabaer @kipmcc @m2jr @joshdilworth

— Capital Factory (@CapitalFactory) February 3, 2014

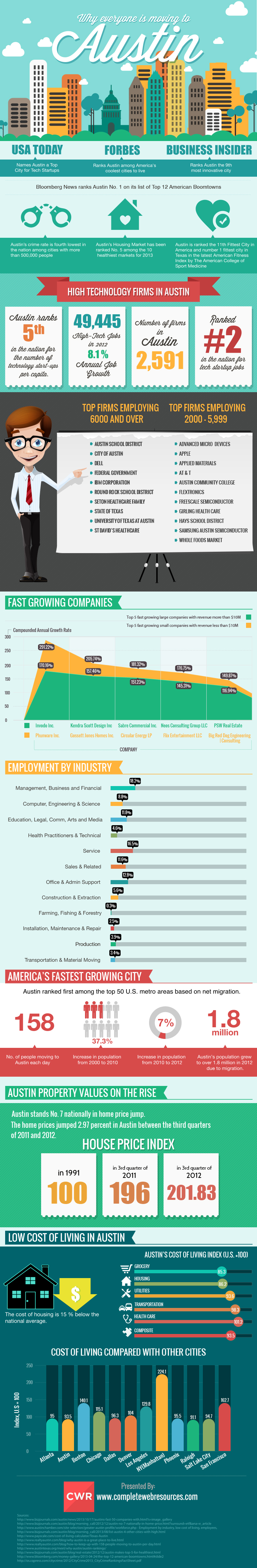

About Capital Factory

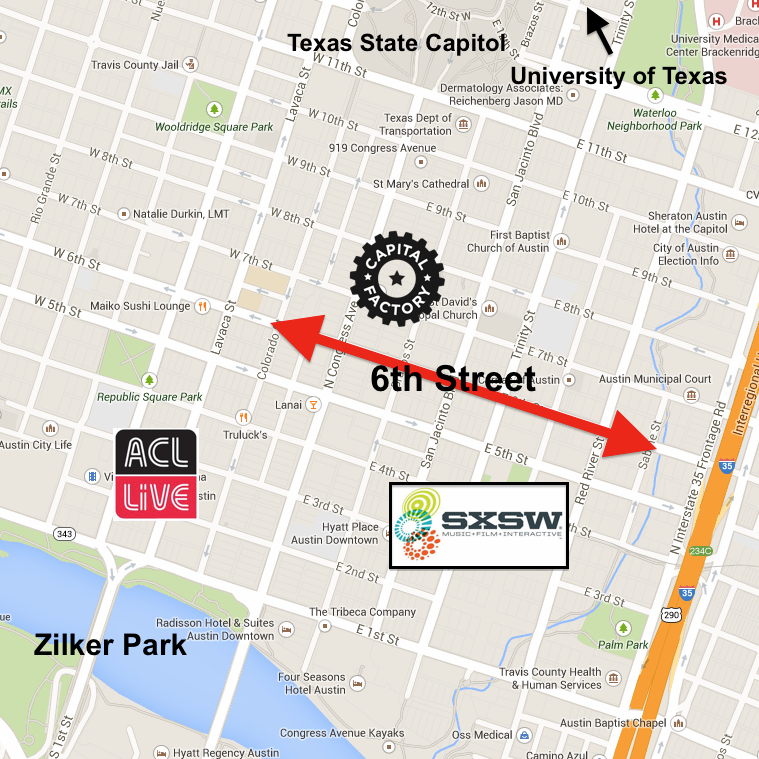

Capital Factory is the entrepreneurial center of gravity in Austin, Texas. Located in the middle of downtown, Capital Factory has 50,000 square feet full of startups and entrepreneurs. Members take classes to learn the skills that startups need, attend meet ups to find a co-founder, rent a desk for their startup or apply for funding and mentorship in the Incubator.

Our mission is to improve entrepreneurial outcomes. We invest intellectual, social, human, and real capital in passionate entrepreneurs who want to change the world. In so doing we also create new jobs and new advantages for Central Texas.

About Silverton Partners

Silverton Partners is an early-stage venture capital firm based in Austin, Texas. Silverton collaborates with exceptional entrepreneurs who are committed to attacking growth markets with cutting-edge products or services.

The principals of Silverton Partners have over two decades of venture experience in IT infrastructure and management software. They have invested in start-ups such as Tivoli Systems (IPO/acquired by IBM), Hyper9 (acquired by Solar Winds), SpareFoot, WPEngine, and SailPoint.

About FLOODGATE

FLOODGATE is a Silicon Valley based, early-stage micro-VC fund focused on startups that fundamentally disrupt existing large markets or create new market categories.

The firm’s portfolio includes consumer-focused companies such as Twitter, ngmoco, Modcloth, Lyft, Playdom, Refinery29, TaskRabbit, Reputation.com, Smule, and Weebly as well as business-focused companies such as Ayasdi, Bazaarvoice, BigCommerce, ClearSlide, DoubleDutch, Egnyte, Okta, Sparefoot, Spiceworks, UpThere, and Xamarin.

Media contact

Josh Jones-Dilworth

Jones-Dilworth for Capital Factory

josh@jones-dilworth.com

917-209-2956

Or visit

http://capitalfactory.com/press