Revealing Company Info Before Getting an Acquisition LOI

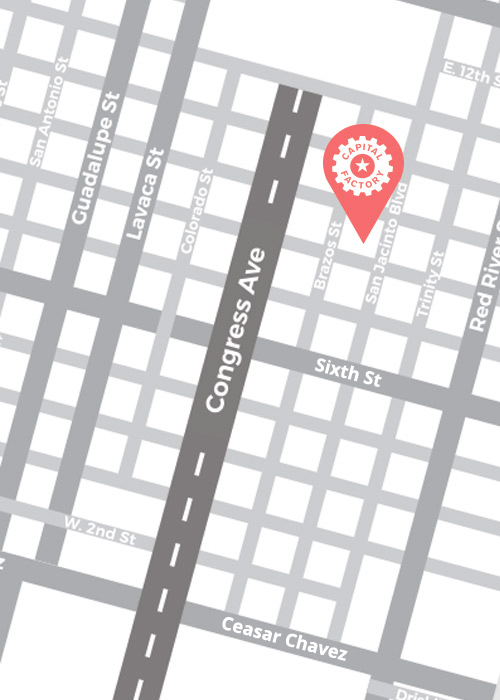

(Contributed by Gordon Daugherty, Capital Factory President)

When an interested acquirer approaches you, they will naturally ask for as much information as you are willing to give them. But how much and what type of information should you provide before you know the terms of their proposed offer? The answer is, it depends. Also realize I’m always initially skeptical when another company approaches with the desire to talk about potential acquisition. My experience suggests that 30% of the time the interest is mostly a fishing expedition and 95% of the time no LOI is reached. Let’s explore further.