Saturday Startup Spotlight: Zirtue

Capital Factory’s Saturday Startup Spotlight series continues this week with the CEO and Co-Founder of Zirtue: Dennis Cail. If you’ve ever been in a situation where you either lent money to a friend or perhaps borrowed some cash from them (and forgot to pay them back), Zirtue has a solution for you.

It’s time to lend and borrow money on Your Terms. We got to chatting about the world of FinTech as well as the elusive credit market that hadn’t been formalized until Zirtue hit the scene.

https://www.instagram.com/p/BrdQGcVAFj5/?utm_source=ig_web_copy_link

Can you introduce yourself & give us your elevator pitch?

I’m Dennis Cail, CEO and Co-Founder of Zirtue, and I am a recovering entrepreneur with a passion for leveraging technology to solve huge problems for businesses and consumers alike. Zirtue is a relationship-based lending application that simplifies loans between friends and family with automated ACH payments for the repayment process. We’re seeking to create a more financially inclusive world by digitizing and mobilizing loans between friends and family. Part of this came about because, several years ago, I had family members that would borrow money from me and I had limited success in getting that money back. The thought process was: there should be a way to make people more accountable, but taking the awkwardness out of the process.

According to estimates from the federal reserve bank, friends and family in the United States lend and borrow almost 200 billion dollars a year with each other. What that said to me was, Zirtue is not a platform that’s trying to convince people that they should be lending and borrowing money with each other — they’re already doing that.

Until now, they just haven’t had that platform to put the structure around it to formalize the loan process.

Wow! The statistic of 200 billion dollars in loans between family & friends— we didn’t know the number was THAT large. That’s pretty intense.

It’s the only credit market that hasn’t been formalized, and there’s really no infrastructure to support it (until Zirtue). You’re signing a digital promissory note, there’s a payment schedule that shows your principal plus your interest, you agree to it and once you make that agreement — the app takes over from there.

What are the current goals you have in mind for Zirtue to achieve?

Short term, we’re planning on hitting 100,000 users by the end of the year — which is really our year one target. That puts us in a place where we’ll be close to 2 million dollars in annual revenue. At that point we’ll go and raise our Series A round, and we’re actually closing out our Seed round which is what we call a Late Seed. It’s a million dollar raise that’s going to get us through the next 9 months to a year; all of that money is going towards user acquisition.

Assuming we hit our metrics, we’ll do our Series A which will be used to expand the geos outside the United States into Mexico, India and other parts of Latin America as well.

As a startup founder, what problems or pain points are you struggling with?

The main thing is making sure that we protect the integrity of the platform from a security standpoint. Because we’re a FinTech company, we have to follow all of the bank laws and regulatory laws. Anything AML (Anti-Money Laundering) and KYC (Know Your Customer), we have very strong restrictions around that. Zirtue has to verify that every user on the platform is who they say they are.

The thing that I keep my finger on the pulse on is making sure that we have all the right security checkpoints in place, and also checks and balances, while making sure the user experience is very intuitive. That’s more of an art than a science, because you don’t want to create unnecessary friction points between your app and users — but at the same time you want people to feel like this is a safe place to process a loan or transactions. I’m really obsessed with those two things: user experience and security.

What kind of connections and experiences are you looking to find here at Capital Factory? Who would you like to meet?

Any corporate introductions, especially from a potential partnerships standpoint with Zirtue, would be very attractive for us. We know Capital Factory is very plugged into the corporate community, and they have a mutual interest in Capital Factory from an innovation standpoint. When those opportunities do present themselves, we’d certainly be interested in meeting as many corporate partners as we can to figure out if there’s some synergies now, or downstream, that we can potentially leverage.

In addition to that, I would say probably any late Seed or Series A investors that are pretty active and have an eye for FinTech.

There are many opportunities that will present themselves— especially with Capital Factory’s Innovation Council becoming more active everyday. Last question: If our community can take away one key point or idea about Zirtue, what would that be?

We are creating a more financially inclusive world by digitizing and mobilizing loans between friends and family. That’s the one big takeaway, from that comes everything else that Zirtue does.

Outside of the U.S. we’ve become a major platform for the unbanked. People that don’t have access to a bank account, checking or savings — Zirtue essentially becomes that bank with virtual cards. You can still lend money between friends and family, but you can now put it to use in real time.

Here in the U.S. we’re dealing with a lot of underbanked people who may have access to basic checking and savings, but can’t get the bank to give them a credit card or a personal loan. Other products outside of a basic checking and savings are really out of reach for a lot of the population. So, we’re serving that demographic and trying to cut down on predatory lending as far as the 400% payday loans and 30% credit cards, for example. From an alternative standpoint, Zirtue just makes a lot more sense.

Thank you for taking the time to talk to us, Dennis!

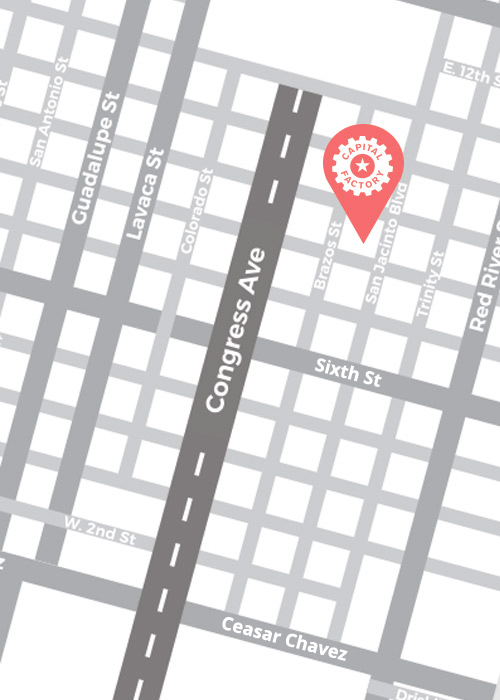

Does his story sound familiar? Are you looking for some meaningful introductions that can lead to a game-changing partnership? Attend our ATX Startup Crawl at Austin Startup Week! You’ll be able to tour the latest and greatest companies in Austin’s startup community alongside fellow entrepreneurs, corporate groups and tech enthusiasts.

Do you have a startup that you want to take to the next level? We’ve got the connections you need to make some big strides. Learn more about our VIP Accelerator program and how to apply.

Don’t miss out on future networking opportunities to meet more entrepreneurs like Dennis, along with our investor, mentor and corporate network. You can also subscribe to our Austin Tech Live or Dallas Tech Live newsletters to receive exclusive updates on our community, events and announcements.